carried interest tax rate 2021

In January 2021 the US. Your 2021 Tax Bracket To See Whats Been Adjusted.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead.

. House Democrats Float 265 Top Corporate Rate in Tax Blueprint. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity. The carried interest loophole allows investment managers to pay the currently lower 20 percent long.

As long awaited by the Hong Kong private equity funds industry the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 the. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue. 18 and 28 tax rates for individuals for residential property and carried interest 20 for trustees or for personal representatives of someone who has died not including.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried.

The Congressional Budget Office has estimated that taxing carried interest as ordinary income. At most private equity firms and hedge. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today.

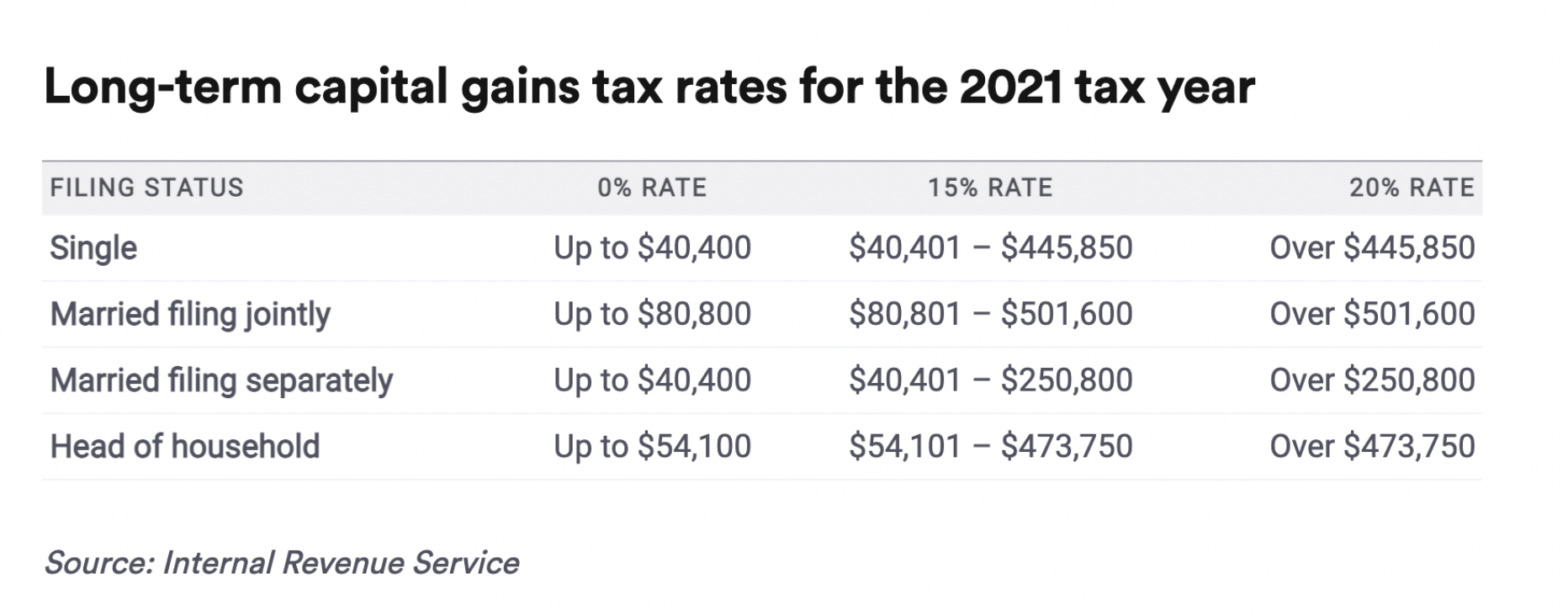

Carried Interest Fairness Act of 2021. This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of. Senators Baldwin Manchin and Brown.

As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue Code IRC. A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28. Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Taxing carried interest as ordinary income would thus increase. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest. Ad TaxInterest is the standard that helps you calculate the correct amounts.

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. Top marginal income tax rate is 434 percent 396 percent plus the 38 percent Medicare surtax if applicable. Carried Interest Fairness Act of 2021.

Ad Compare Your 2022 Tax Bracket vs.

What Are Marriage Penalties And Bonuses Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Banking Financial Awareness 20th December 2019 Awareness Banking Financial

Sec 199a And Subchapter M Rics Vs Reits

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

What You Need To Know About Capital Gains Tax

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Doing Business In The United States Federal Tax Issues Pwc

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Rate Of Interest On Gpf And Other Similar Funds Including Sds 1975 W E F 1st April 2021 For 1st Quarter Of Financial Year 2021 22 In 2021 Financial Fund Budgeting

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Wfh And Your Taxes Wfh The New Normal What The Heck

New York Tax Rates Going Up With A Twist Hodgson Russ Llp Jdsupra

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post